Purchasing Boat Insurance In US

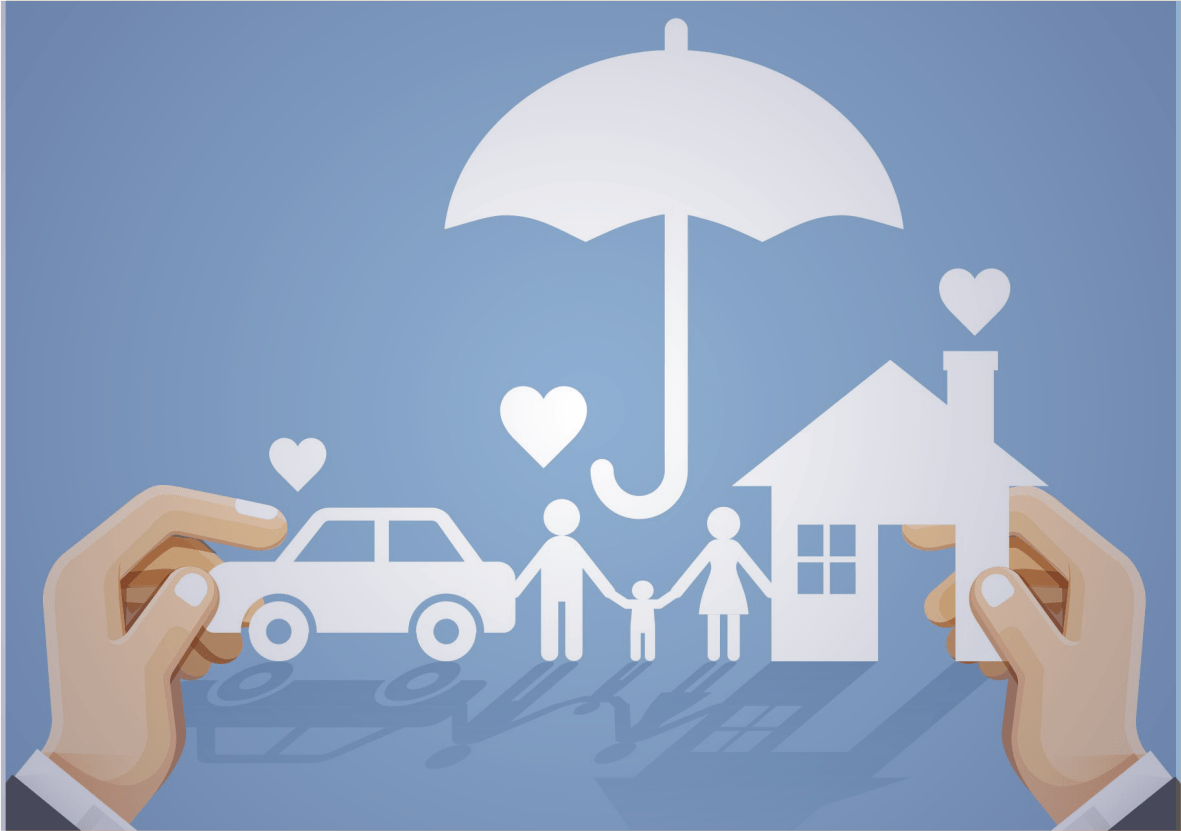

Purchasing a boat is a significant financial commitment, so it’s essential to insure your asset, just like you would with a car or house. In the US, Boat Insurance is intended to shield boat owners financially from a range of hazards, such as theft, accidents, natural disasters, and liability for harm or property damage. But selecting the best boat insurance coverage necessitates giving serious thought to a number of variables.

Boat Insurance is a type of coverage that protects your boat, passengers, and financial interests from a variety of potential threats. It works similarly to auto insurance, but is tailored to the unique needs and hazards connected with boating. Boat insurance coverage often cover damage to the boat, liability for injuries or property damage caused to others, and other risks such as theft, vandalism, and weather-related events.

What Is Boat Insurance In US?

Boat Insurance in the United States is a sort of specialized insurance coverage that protects boat owners and their vessels from a wide range of dangers. Boat insurance, like car insurance, protects boats and personal watercraft (PWC) such as jet skis from accidents, damage, theft, and liability claims. While boat insurance is not required by law in all states, it is strongly advised for anyone who owns or operates a vessel.

While Boat Insurance is not required by law in many states, it is strongly advised for all boat owners. Some states mandate insurance for certain types of boats or in specific conditions, such as mooring at a marina. Furthermore, if you finance your boat purchase, your lender is likely to require insurance as a condition of the loan. Even if it is not needed, having insurance gives you peace of mind knowing that you are protected against potentially major financial losses.

Boat insurance is important because it provides financial protection against the various risks associated with owning and operating a boat. Boats can be expensive to repair or replace, and the costs associated with accidents, injuries, or legal claims can be significant. This article discusses the most important elements to consider when getting boat insurance in the United States.

Types of Boats Covered

When purchasing boat insurance, it’s essential to understand the types of boats that are typically covered under these policies. Most insurance providers offer coverage for a wide range of watercraft, including motorboats, sailboats, yachts, personal watercraft like Jet Skis, and houseboats.

Motorboats

Motorboats include speedboats and fishing boats, are among the most common types of boats covered by insurance policies. These boats are generally used for recreation, fishing, or water sports. Sailboats, which rely on wind power, are also commonly insured. They can range from small dinghies to large ocean-going vessels. Yachts, which are larger and often more luxurious, require specialized coverage due to their higher value and the extended voyages they typically undertake.

Personal watercraft

Personal watercraft such as Jet Skis and Sea-Doos, are also covered under most boat insurance policies. These are small, recreational watercraft that are popular for their speed and maneuverability. Houseboats, which serve as floating homes, require unique insurance considerations due to their dual nature as both a vessel and a residence.

It is important to note that some types of watercraft, such as kayaks, canoes, or inflatable boats, may not require a specialized boat insurance policy. Instead, these may be covered under your homeowner’s or renter’s insurance. However, larger, motorized boats generally require dedicated boat insurance to ensure comprehensive coverage.

Boat Insurance Coverage Options

Boat insurance policies offer various types of coverage, each designed to protect different aspects of your boating experience. Understanding these coverage options is crucial to choosing the right policy for your needs.

Liability Coverage

Liability coverage is one of the most critical components of boat insurance. This coverage protects you against legal liability if you cause injury to another person or damage their property while operating your boat. It typically includes bodily injury liability, which covers medical expenses and other costs related to injuries sustained by others, and property damage liability, which covers repairs or replacement costs for damaged property. Pollution liability is another aspect of liability coverage that covers the cost of cleaning up accidental oil spills or fuel leaks, which are common risks associated with boating.

Physical Damage Coverage

Physical damage coverage is designed to protect your boat itself. This coverage typically includes protection against a wide range of perils, such as collisions, grounding, fire, theft, vandalism, and weather-related incidents like lightning or hail. Physical damage coverage can be further divided into agreed value and actual cash value options.

Agreed value coverage reimburses you for the agreed-upon value of your boat at the time the policy is written, providing more predictable payouts in the event of a total loss. Actual cash value coverage, on the other hand, reimburses you for the current market value of your boat, taking depreciation into account, which can result in lower payouts as your boat ages.

Comprehensive Coverage

Comprehensive coverage extends beyond physical damage coverage to include protection against theft, vandalism, and natural disasters. This type of coverage is particularly important for boat owners who store their boats in areas prone to severe weather events, such as hurricanes or tornadoes, or who are concerned about theft and vandalism while their boat is docked or stored.

Uninsured/underinsured boater coverage is another essential option, particularly given that boat insurance is not mandatory in all states. This coverage protects you if you’re involved in an accident with another boater who either doesn’t have insurance or has insufficient coverage to pay for damages. This coverage can be a lifesaver in scenarios where the other party is unable to cover the costs of repairs or medical expenses.

Medical Payments Coverage

Medical payments coverage is designed to help pay for medical expenses incurred by you, your passengers, or anyone injured while on your boat, regardless of who is at fault. This coverage can be particularly valuable in covering immediate medical costs following an accident, ensuring that you and your passengers receive prompt medical attention without worrying about the financial implications.

Towing and assistance coverage is essential for boaters who frequently venture into large bodies of water where access to towing services may be limited. This coverage helps cover the cost of getting your boat back to shore or to a repair facility if it becomes disabled on the water, providing peace of mind in the event of a breakdown.

Personal Effects Coverage

Personal effects coverage protects the valuable items you carry on your boat, such as fishing equipment, electronics, and water sports gear. This coverage ensures that these items are protected against loss, theft, or damage while they are on the boat, adding an extra layer of protection for your personal belongings.

Hurricane haul-out coverage is particularly important for boaters in hurricane-prone areas. This coverage helps pay for the cost of hauling your boat out of the water or securing it in a safe location ahead of a storm. Given the high costs associated with preparing a boat for a hurricane, this coverage can be a significant cost-saving measure, ensuring that your boat is properly secured without breaking the bank.

Conclusion

Purchasing Boat Insurance in the United States is an important step toward protecting your investment and ensuring your financial stability while enjoying time on the water. Understanding the many types of coverage offered, the factors that determine rates, and the special considerations involved allows you to make an informed decision and choose the best insurance for your needs.

Whether you’re an experienced boater or a first-time boat owner, taking the time to properly select your insurance policy can provide you peace of mind and allow you to fully enjoy your boating experience. Boat insurance in the United States is an important instrument for safeguarding boat owners and their vessels against a variety of hazards.

Having the proper insurance coverage guarantees that you are financially covered against mishaps, theft, natural disasters, and liability claims, regardless of the size of your vessel—a tiny fishing boat, a luxury yacht, or a personal watercraft. Boat insurance is a crucial component of prudent boat ownership, even if it’s not often required by law. It offers financial stability and peace of mind when out on the water.