Insurance Companies in a Car Accident

Car crashes are a regrettable fact of contemporary life, frequently resulting in serious financial, medical, and psychological repercussions for individuals concerned. One of the most important parties in the aftermath of an accident is the insurance provider in terms of reimbursement and recovery.

In terms of handling claims, offering financial assistance, and assisting in the settlement of conflicts, insurance firms are essential. Finding out how much insurance each party has available to them in the case of an automobile accident is frequently the first thing to do.

Different kinds of coverage, including liability, collision, and personal injury protection, are usually included in insurance plans. It is vital that all parties comprehend the precise provisions and constraints of these policies in order to proficiently handle the claims procedure.

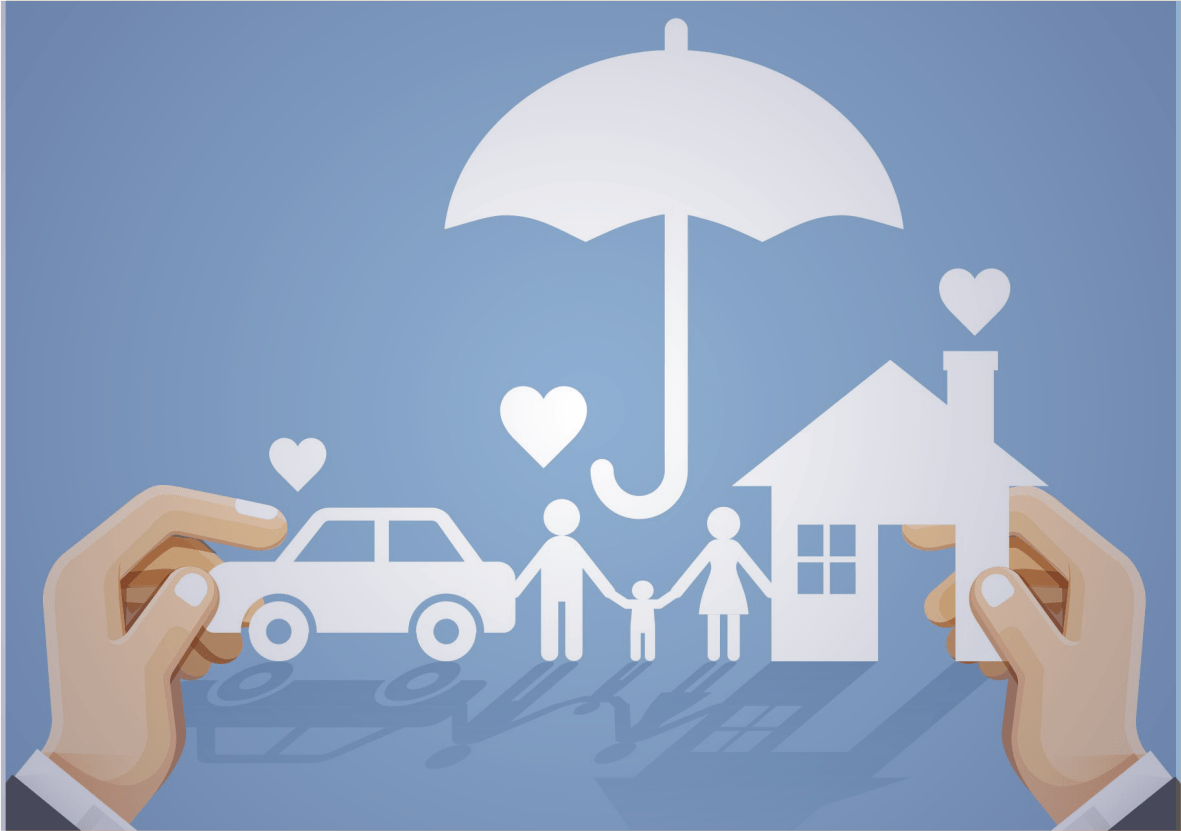

What are Insurance Companies ?

Insurance Companies are organizations that offer monetary security to people or things involved in auto accidents. To lessen the financial risks connected with auto accidents, these businesses provide a range of insurance coverage options, such as liability, collision, and personal injury protection. Insurance firms are essential to the management of claims, determination of culpability, and payment of damages to impacted parties following an event.

Generally speaking, government agencies have put in place regulatory frameworks for insurance businesses to follow in order to guarantee honest and open business practices. They take on the risk of possible damages from auto accidents in return for policyholders paying premiums.

Insurance companies assist people in automobile accidents by offering them financial assistance and protection, guiding them through the intricacies of the claims procedure, and helping them recover from the effects of unanticipated roadside incidents.

Insurance Companies Roles In Car Accidents

In the case of an accident, insurance firms are in charge of looking into the details of the incident, establishing who is at fault, and calculating how much damage each party has suffered. In the wake of an automobile accident, insurance firms play a complex role that is explored in this article, which looks at their duties, procedures, and effects on all parties.

Reporting the Accident

The process of submitting and overseeing claims made by policyholders injured in auto accidents is handled by insurance companies. This include compiling event details, evaluating the claim’s viability, and figuring out how much money should be awarded in compensation.

It is critical that you notify the appropriate insurance companies of an accident as soon as possible. Usually, this entails giving specific details about the mishap, such as the date, time, place, and account of the sequence of events that preceded the impact. Complications or delays in the claims procedure may arise from failing to report an accident in a timely way.

Claims Assessment and Investigation

Insurance companies investigate and examine claims thoroughly in order to establish culpability and estimate the level of losses. Gathering information, examining police records, getting witness accounts, and determining the extent of injuries may all be part of this procedure. The objective is to come to a just and equitable decision that makes up for the losses suffered by all parties.

Settlement Negotiations

Insurance companies negotiate settlements with impacted parties following the completion of the evaluation and inquiry. Insurance adjusters, attorneys, and the accident victims themselves frequently communicate during this process. The goal of settlement talks is to come to a compromise that would adequately reimburse the harmed party for lost earnings, medical expenditures, property damage, and other related costs.

To get at a settlement that addresses the claim in a just and expedient manner, insurance companies negotiate with the parties involved. This might include exchanging information with the accident victims, insurance adjusters, and attorneys.

Litigation and Legal Proceedings

Parties to a dispute may occasionally have disagreements that result in litigation and other legal actions. Insurance firms may engage legal representation to safeguard their interests in court and fight against liability or carelessness allegations. The necessity of careful inquiry and discussion is highlighted by the possibility that litigation may lengthen the settlement process and result in higher expenses for all parties.

Subrogation

A legal principle known as subrogation enables insurance companies to recoup expenses from uninvolved people that cause accidents. After paying its policyholder’s losses, an insurance company may file a lawsuit to recoup the money it paid out to the policyholder’s insurance provider or the negligent party. Insurance firms use subrogation to reduce losses and keep premiums affordable for policyholders.

If an outside person is held accountable for the accident, insurance companies may file a lawsuit through subrogation in order to recoup expenses related to paying policyholder compensation. By doing this, insurance firms are able to reduce their losses and collect money from negligent parties or their insurance providers.

Providing Support and Assistance

Insurance companies help those injured in auto accidents by offering support and assistance in addition to monetary recompense. This might entail setting up the vehicle’s repairs, arranging for medical care, and providing therapy to deal with the mental stress brought on by the collision. Insurance providers make an effort to fulfill their duty of care and assist policyholders during the healing process.

Insurance companies may offer aid and support to victims of auto accidents in addition to monetary recompense. This might entail setting up the vehicle’s repairs, arranging for medical care, and providing therapy to deal with the mental stress brought on by the collision.

Regulatory Compliance and Consumer Protection

The regulatory environment in which insurance businesses operate is intended to safeguard customers and guarantee honest and open business practices. Regulatory bodies supervise the insurance sector, establishing guidelines for coverage, managing claims, and resolving conflicts. For insurance businesses to remain credible and preserve policyholder trust, they must adhere to regulatory regulations.

Conclusion

In summary, insurance companies are essential in the aftermath of an automobile accident because they offer financial security, streamline the claims procedure, and help people overcome their recovery obstacles. All parties may successfully negotiate the complexity of insurance coverage and pursue just recompense for their losses by being aware of the roles and procedures involved.

Insurance adjusters determine how much each party in the collision has to pay out in damages. This covers charges for repairing damaged automobiles, paying for medical care for wounds received, and other related costs like missed income or car rentals. In the end, insurance firms want to give their customers protection and peace of mind by making sure they are sufficiently covered in the case of unanticipated events while driving.