Insurance Planning In Wealth Management

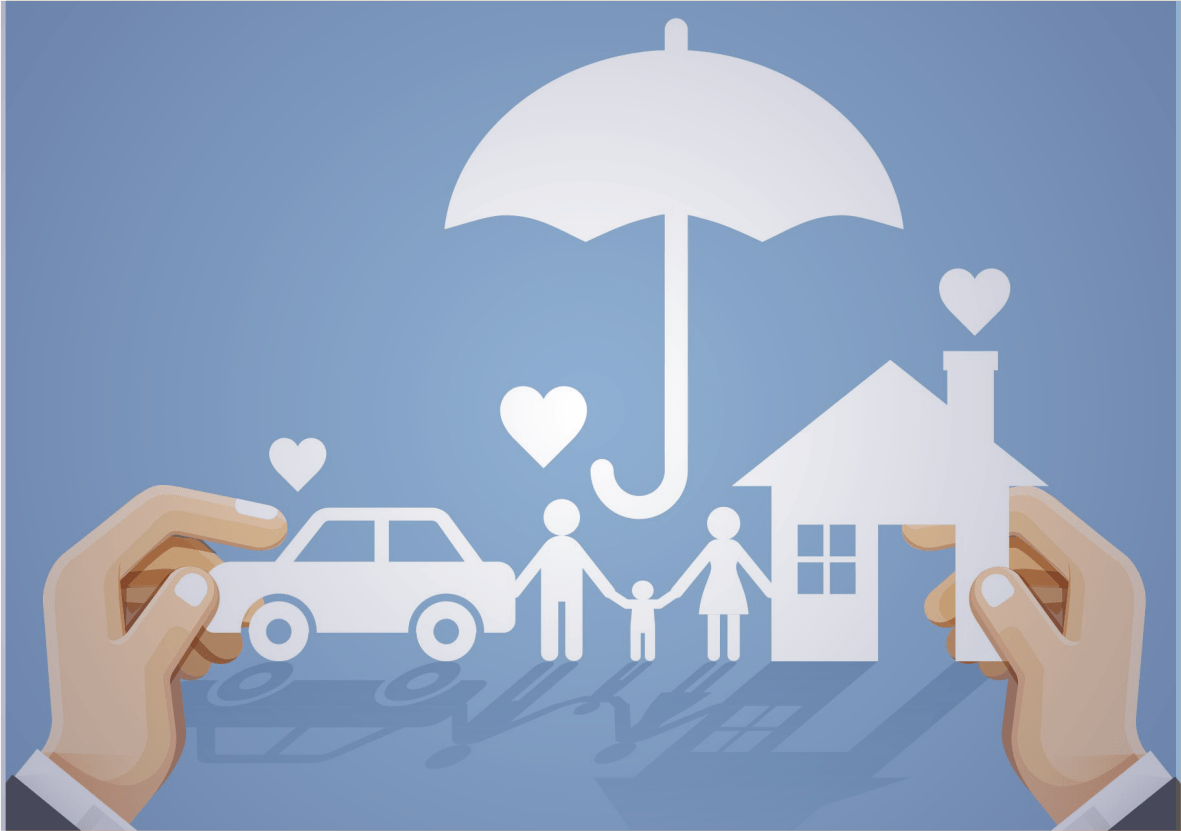

The goal of wealth management is to increase and protect one’s financial holdings over time via a variety of tactics and procedures. Insurance planning is an equally important component that should not be disregarded, even if investments, savings, and estate planning are frequently at the center of wealth management talks. Insurance planning is essential for safeguarding assets, reducing risks, and providing families and individuals with financial stability and peace of mind.

Insurance planning entails analyzing an individual’s or family’s insurance needs and selecting appropriate insurance policies to manage risks and safeguard against financial loss. Insurance planners provide recommendations for insurance products including life, health, disability, property and casualty, and long-term care insurance based on this evaluation.

What is Wealth Management ?

Wealth management is the professional administration of a person’s or family’s financial assets and investments with the purpose of achieving certain financial objectives. It entails a holistic approach to financial planning, investment management, tax planning, estate planning, and risk management that is tailored to the specific requirements and circumstances of affluent customers.

Wealth management seeks to create and maintain wealth over time, optimize investment returns, reduce tax costs, and assure customers’ financial stability and well-being. Wealth managers are trusted consultants who assist customers make challenging financial decisions and handle life’s transitions with confidence and peace of mind.

Wealth management is a comprehensive and integrated strategy to managing the financial affairs of rich individuals and families that includes a wide range of services and methods aimed at preserving and growing wealth, achieving financial objectives, and ensuring long-term financial stability and success.

What is Insurance Planning ?

Insurance Planning is the process of determining the right insurance products to minimize risks and guard against monetary loss after evaluating an individual’s or entity’s insurance needs. An extensive assessment of one’s financial status, including assets, obligations, income, and spending, is usually the first step in this procedure.

In order to find insurance solutions that offer sufficient coverage and financial security in the case of unanticipated occurrences, it entails examining the many risks that a person or business may encounter. Planning for insurance tries to address the risks and uncertainties that might endanger one’s financial security and create plans for successfully managing those risks.

These products are designed to meet certain risks and goals. This article examines the role that insurance planning plays in wealth management, emphasizing how important it is for controlling liabilities, protecting assets, and reaching long-term financial objectives.

Risk Management and Asset Protection

Risk management and asset protection are two main goals of insurance planning in wealth management. Because life is unpredictable by nature, unforeseen circumstances like sickness, accidents, natural catastrophes, or early death can have disastrous financial repercussions.

Insurance acts as a safety net to assist people and families reduce these risks and shield their assets from unanticipated circumstances. People can protect themselves against devastating financial losses that could otherwise wipe out their assets and threaten their financial stability by shifting risk to an insurance provider.

Income Replacement and Financial Stability

Life insurance is essential for maintaining financial stability and replacing income, especially for major breadwinners in a home. The profits from a life insurance policy can help surviving family members by covering living expenses, paying off debts, replacing lost income, and supporting future financial objectives like retirement or schooling. After a catastrophe, life insurance makes sure that loved ones don’t become impoverished, enabling them to continue living comfortably and pursuing their long-term goals.

Health and Long-Term Care Coverage

Insurance planning must include both health and long-term care insurance, especially as people age and face rising medical expenses. Health insurance lessens the financial strain on people and families by helping to cover medical expenditures such as hospital stays, doctor visits, prescription drugs, and preventative care.

In order to ensure that people receive the care they require without exhausting their resources or assets, long-term care insurance covers the costs associated with prolonged medical and custodial care services, such as home healthcare, assisted living facilities, and nursing facility care.

Protection Against Liability and Litigation

Strategies to guard against liability and litigation risks that might jeopardize one’s financial security are also included in insurance preparation. Liability insurance, which includes renters’, homeowners’, and umbrella insurance, covers losses and court costs resulting from lawsuits brought against the insured for property damage or bodily harm. These insurance plans protect people from prospective legal action and financial liabilities, protecting their assets and insulating them from the financial fallout from legal conflicts.

Business Continuity and Succession Planning

Insurance preparation is crucial for entrepreneurs and company owners to ensure business continuity and enable seamless succession planning. Business insurance helps shield companies against monetary losses brought on by unforeseen circumstances like the passing away or incapacity of a vital employee or owner.

Examples of this type of insurance include key person insurance, business interruption insurance, and buy-sell agreements financed by life insurance. These insurance options guarantee that companies can carry on in the event of difficulty and offer monetary assistance to ease succession planning and ownership transfers.

Estate Planning and Wealth Transfer

In order to transfer money and arrange an estate tax efficiently, insurance planning is essential. It allows people to pass on their assets to future generations. By using life insurance as a vehicle to generate liquidity for estate taxes, heirs can pay taxes without having to liquidate assets or use up the entire inheritance. Furthermore, the proceeds from a life insurance policy can be assigned to certain beneficiaries outside of the probate process, allowing for a quick and tax-free transfer of money to close ones.

Diversification and Portfolio Protection

A thorough wealth management plan should include insurance products to help diversify risk and shield investment portfolios from market fluctuations and downturns. Annuities and permanent life insurance with cash value accumulation are two examples of insurance products that may be used in addition to more conventional investment vehicles like stocks and bonds since they provide stability and guaranteed returns. Through asset class diversification, which includes insurance-based products, investors may lower the total risk of their portfolio and increase long-term returns.

Conclusion

Finally, it should be noted that insurance planning is an important part of wealth management and should not be disregarded. Insurance planning gives people and families the peace of mind and confidence to achieve their financial goals and objectives by managing risks, safeguarding assets, and guaranteeing financial stability.

Insurance has several purposes in preserving wealth and improving overall financial well-being, including insuring against unanticipated occurrences, replacing income, paying for medical expenses, and assisting with estate planning and asset transfer. Insurance planning, when included in a complete wealth management strategy, assists people in preparing for life’s uncertainties and lays the groundwork for long-term financial success.