The Main Types Of Business Insurance

There are several hazards associated with operating a business, ranging from liability to harm to property. Businesses frequently invest in insurance coverage catered to their particular requirements in order to protect themselves against these risks.

Business insurance is critical for ensuring the financial security of a firm, its assets, workers, and stakeholders. Businesses can reduce possible financial losses and obligations by shifting some risks to an insurance provider, giving them more peace of mind to focus on development and innovation.

What is Business Insurance ?

Business Insurance refers to a variety of products meant to protect businesses against financial losses caused by unforeseen occurrences or dangers. Property damage, liability claims, litigation, employee injuries, natural catastrophes, and other unanticipated incidents that might disrupt operations or cause financial loss to the organization are examples of such events.

Business insurance plans often cover many areas of a company’s activities, assets, and liabilities. Depending on their sector and region, many firms are also obliged by law to carry specific forms of insurance, such as workers’ compensation or commercial auto insurance. Overall, business insurance is critical for controlling risk and guaranteeing the long-term viability and profitability of firms in a variety of industries.

In addition to providing financial security, business insurance gives entrepreneurs peace of mind so they can concentrate on expansion and innovation without having to worry about their finances all the time. We’ll examine the primary categories of business insurance in this thorough guide, including their functions, scope, and importance.

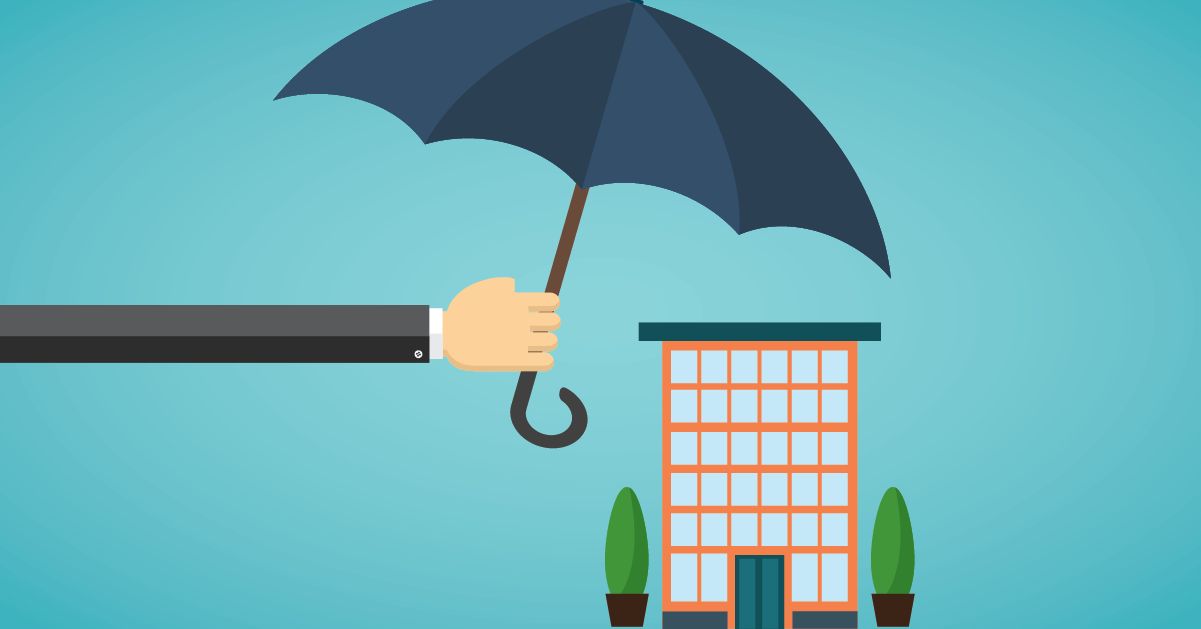

Property Insurance

Property insurance, which covers tangible assets like buildings, machinery, stock, and furnishings, is a crucial part of corporate risk management. It offers defense against hazards including natural catastrophes, theft, vandalism, and fire. Property insurance coverage may be customized to meet the needs of any kind of business, from huge manufacturing facilities to little retail stores. The cost of replacing or repairing damaged property is usually covered, as are business interruption costs in the event that covered occurrences cause operations to be temporarily suspended.

General Liability Insurance

The purpose of general liability insurance is to shield companies against lawsuits alleging physical harm or property damage brought on by their operations, goods, or services. It offers coverage for court expenses, settlements, and awards in cases filed by outside parties, including clients, suppliers, or guests hurt on company property.

Advertising and personal harm claims, such as those involving defamation or copyright infringement, are also covered by general liability insurance. General liability insurance is crucial for companies that often deal with the public or other organizations in order to reduce the possibility of future legal action.

Professional Liability Insurance

Professional liability insurance, also referred to as errors and omissions (E&O) insurance, is essential for companies that offer professional services or advice. It guards against accusations of carelessness, mistakes, or omissions that cause clients to suffer monetary damages.

This kind of insurance is frequently carried by professionals, including physicians, attorneys, architects, consultants, and accountants, to protect their money and reputations in the event that they are sued for professional misconduct. Professional liability insurance usually pays for the expense of the claimant’s defense as well as settlements and damages.

Workers’ Compensation Insurance

In most countries, workers’ compensation insurance is mandated by law and offers benefits to workers who sustain illnesses or injuries at work. Regardless of responsibility, it pays for missed earnings, medical expenditures, and rehabilitation for workers hurt on the job.

Employees typically give up their ability to sue their employers for carelessness in return for these perks. In addition to protecting workers, workers’ compensation insurance also covers companies against expensive legal actions and fines brought on by workplace accidents.

Commercial Auto Insurance

Businesses that own or operate automobiles for business purposes must have commercial auto insurance. Commercial auto insurance offers coverage for property damage, physical injury, and medical costs stemming from incidents involving business-owned vehicles, whether it’s a fleet of delivery vans, corporate automobiles, or trucks hauling commodities. Policies, which cover both company-owned and employee-owned automobiles used for business purposes, can be tailored to the unique requirements of various sectors.

Cyber Liability Insurance

Cyber liability insurance has become essential for companies of all sizes in an increasingly digital environment. This kind of insurance guards against cyberattacks, data breaches, and other online dangers that might jeopardize confidential data and interfere with regular corporate operations.

charges for data recovery, forensic investigations, legal fees, notification charges, and fines imposed by regulators on data breaches are all covered under cyber liability plans. To protect their digital assets and minimize financial damages, organizations require comprehensive cyber liability insurance due to the increasing frequency and complexity of cyber attacks.

Business Interruption Insurance

When a firm must halt operations due to a covered risk, such as a fire, a natural disaster, or civil disturbance, business interruption insurance covers lost revenue and operational costs. It assists companies in their financial recovery by making up the money they would have made during the disruption.

Additional costs required to lessen the effects of the disruption, including hiring temporary buildings or moving activities, may also be covered by business interruption insurance. This kind of insurance is particularly helpful for companies that mostly depend on physical locations and would suffer large financial losses in the event of temporary closures.

Product Liability Insurance

Products that are manufactured, distributed, or sold to the general public must have product liability insurance. It defends against lawsuits alleging that faulty goods—such as those with poor manufacturing quality, inadequate warnings, or flawed designs—have caused harm or property damage.

Product liability insurance helps firms reduce the financial risks associated with product-related lawsuits by covering legal defense expenses, settlements, and damages paid to affected parties. The extra layer of protection that product liability insurance offers against unanticipated product faults and liability claims is particularly beneficial when strict quality control methods are in place.

Conclusion

Business Insurance is an essential instrument for risk management and safeguarding the financial stability of companies in a range of sectors. Entrepreneurs may reduce risks and protect their assets by being aware about the major forms of business insurance and the coverages that each one offers.

Insurance is a vital safety net that helps organizations manage uncertainty with more confidence and resilience, even while it cannot completely remove all risks. Having adequate insurance coverage that is suited to their demands is still crucial for long-term success and sustainability as businesses continue to change and encounter new obstacles.